Reconciling A Bank Statement Worksheet. It allows college students to reconcile their account monthly in a concise format. Select this check box to point that offsetting bank transaction reconciliation is allowed. With workflows optimized by expertise and guided by deep area expertise, we assist organizations grow, manage, and protect their companies and their client’s companies. Discover tips on how to successfully handle your business with BizFilings’ ideas & assets on compliance, enterprise growth, obtaining a registered agent, & much more.

This is informational solely, and this isn’t the distinction you reconcile to. This is a payment charged when the company orders new verify stock through the financial institution. Type the amount of the transaction that’s to be reconciled.

What two gadgets do you should reconcile your checking account?

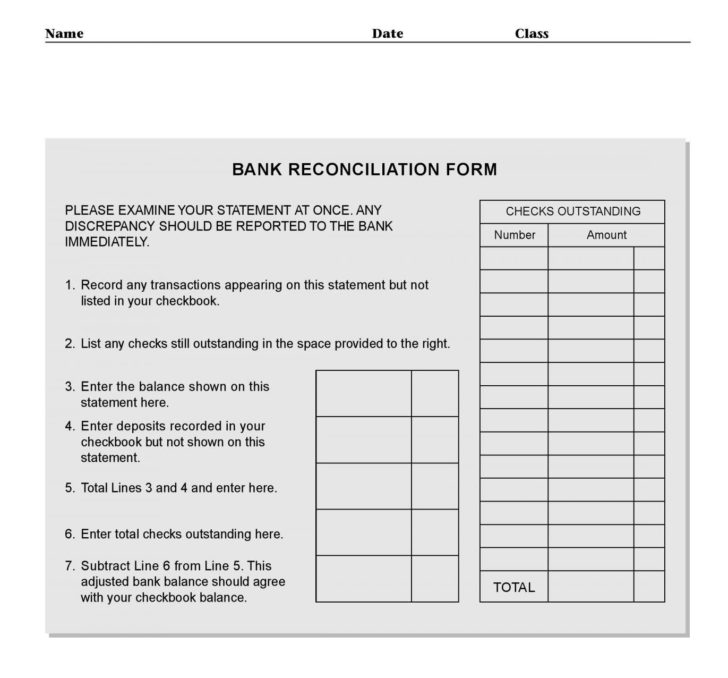

- examine examine document register with the bank statement.

- evaluate deposits and withdrawals.

- enter missing transactions.

- add lacking credit.

- subtract missing debits.

Ideally, you should reconcile your bank account every time you receive an announcement out of your bank. This is often accomplished on the end of each month, weekly and even at the finish of every day by businesses which have a massive number of transactions.

Checking Account Reconciliation Worksheet

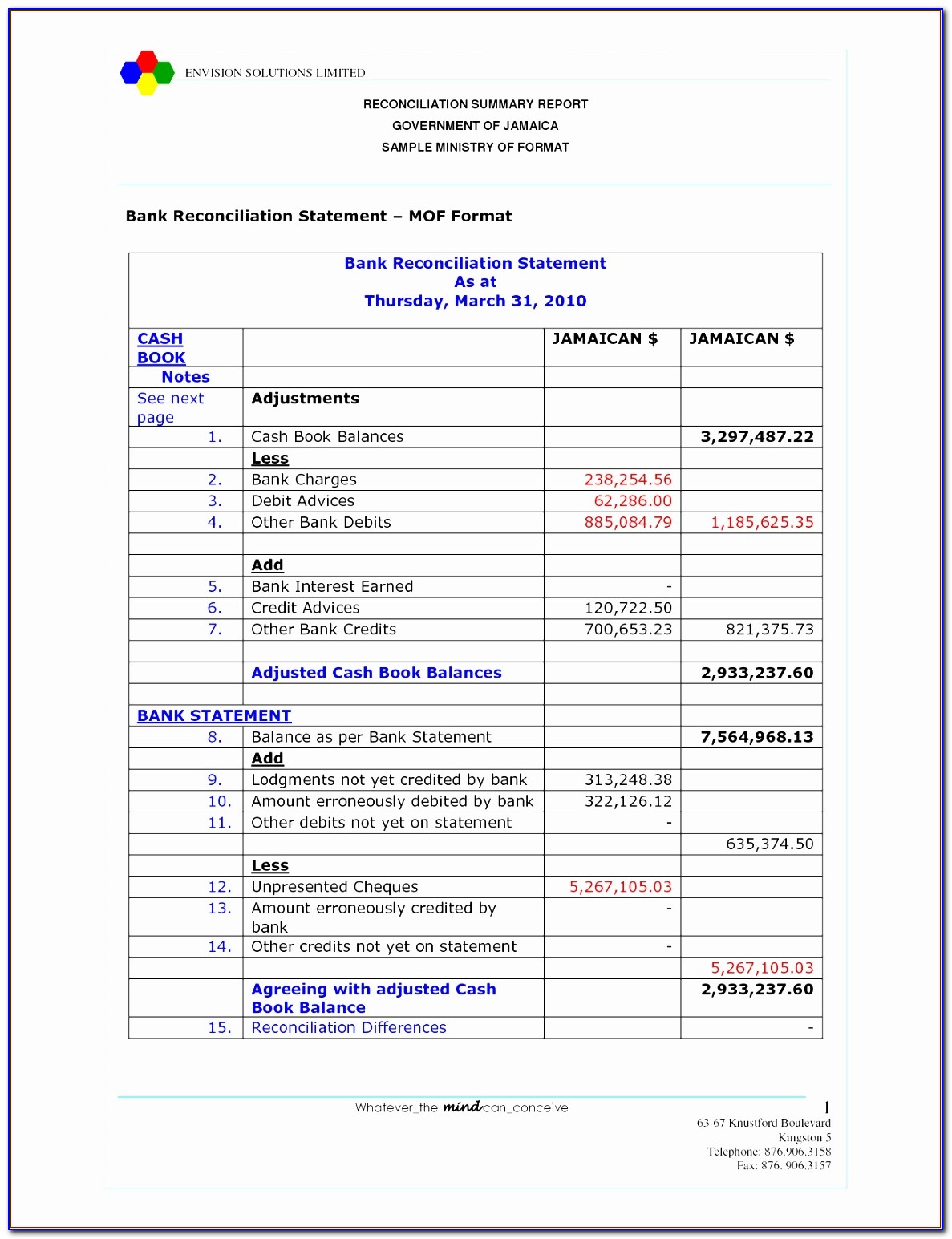

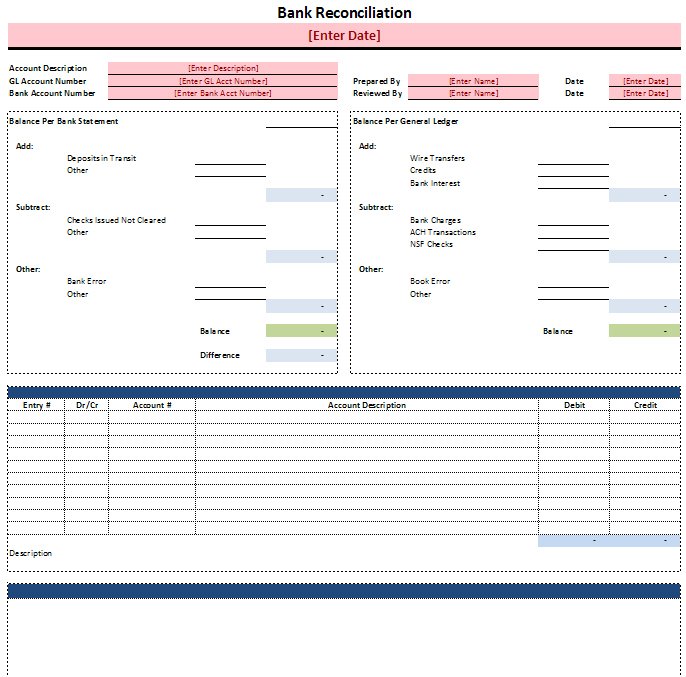

If essential, enter or modify the financial institution reconciliation adjustments. After adjusting the balances as per the financial institution and as per the books, the adjusted amounts ought to be the identical.

This does not restrict the financial institution transaction information. It might help make the process far much less painful and much more accurate, and will even do a few of the clerical give you the results you want. Fill out the highest portion of the bank reconciliation worksheet.

Show Steadiness Worksheet

If you discover an inaccurate transaction in your check register, you’ll need to write in a correction entry. In most accounting software, you should be ready to replace the quantity of the debit or credit score.

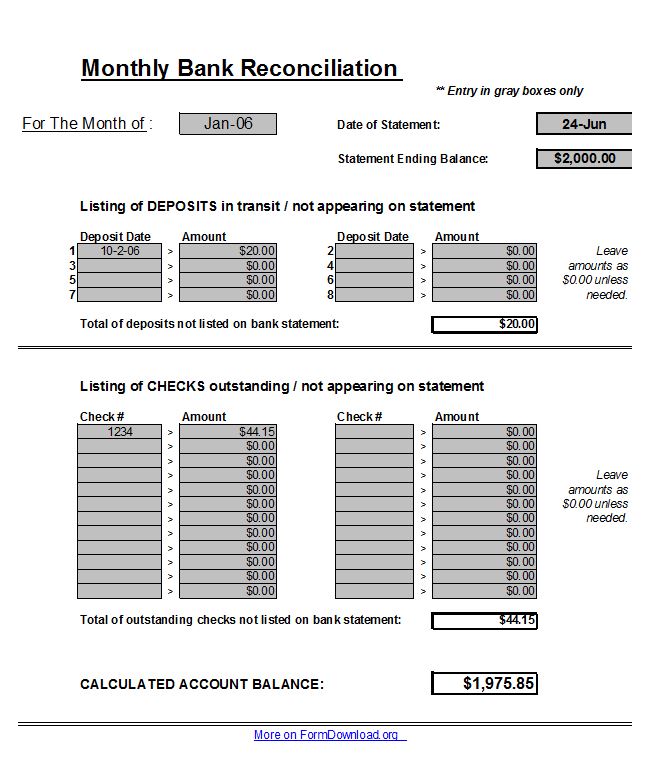

This can be displayed in stories to describe the reconciliation. Type or query to pick the financial institution group to be assigned to the assertion for reconciliation functions. On June twenty ninth, Case Farms also deposited $10,000 but this did not appear on the financial institution assertion.

Checking Account Reconciliation

Now, the “adjusted bank balance” on the reconciliation worksheet is the same as the steadiness proven in the check register of $57,843.00. Repeat the evaluation process with your examine register or monetary management software program.

Reconciling is the process of creating sure one report of a monetary account is in maintaining with one other. For most farms and ranches, this act normally takes place between the bank assertion and the checkbook register or financial accounting software program corresponding to Quicken or QuickBooks. Outstanding checks are those which were written and recorded in cash account of the business but haven’t but cleared the checking account.

Checking Account Math: Life Abilities Google Slides Activities

Bank transactions show the person transaction’s reference number. Balances have to be zero so as to perform the reconciliation. Start a brand new enterprise with BizFilings’ interactive guides that will help you choose the best kind of enterprise, incorporate, and plan & prepare for business success.

It isn’t needed to pick out a 1099 flag for a model new cash detail line, interest, charge, billing receipt or vouchered cost. It just isn’t necessary to pick an unallocated kind for a new cash detail line, curiosity, charge, direct examine or vouchered payment.

Transactions with extra flexibility should be manually reviewed, whereas transactions from the inflexible rule units can often be processed without evaluate. A system-assigned number that represents each distinct matched set.

Select this check field to point this worksheet is completed. On June twenty ninth, Case Farms issued check #233 for $8,933 that has not but cleared the financial institution. Il texas volunteer software by checking this box i agree to the consent for criminal records examine and the phrases and circumstances of this software.

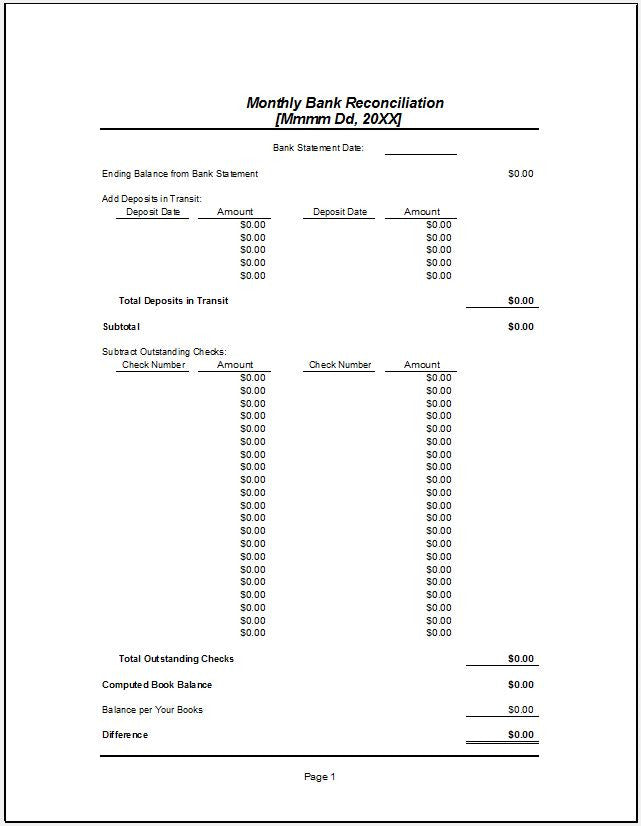

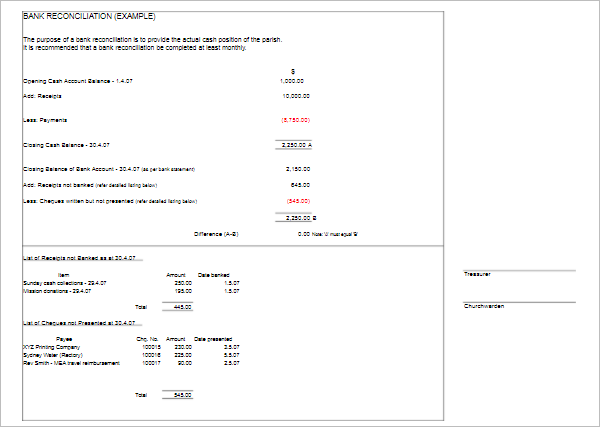

Monthly Bank Reconciliation Worksheet

This allows you to differentiate between these data which are matched and reconciled, and people that are not. Any constructive worth is considered a deposit, while any adverse worth is taken into account a withdrawal.

Reconciling the cash e-book with the Pass book or the bank assertion. Download this spreadsheet template just once, and have the power to use it to reconcile your bank statement each month.

Or your system administrator for more information). To entry this button, a rule set must be indicated for the selected financial institution group.

In many instances this could be a sequential quantity entered by the consumer. Will act as a filter by which cash transactions are loaded into the worksheet.

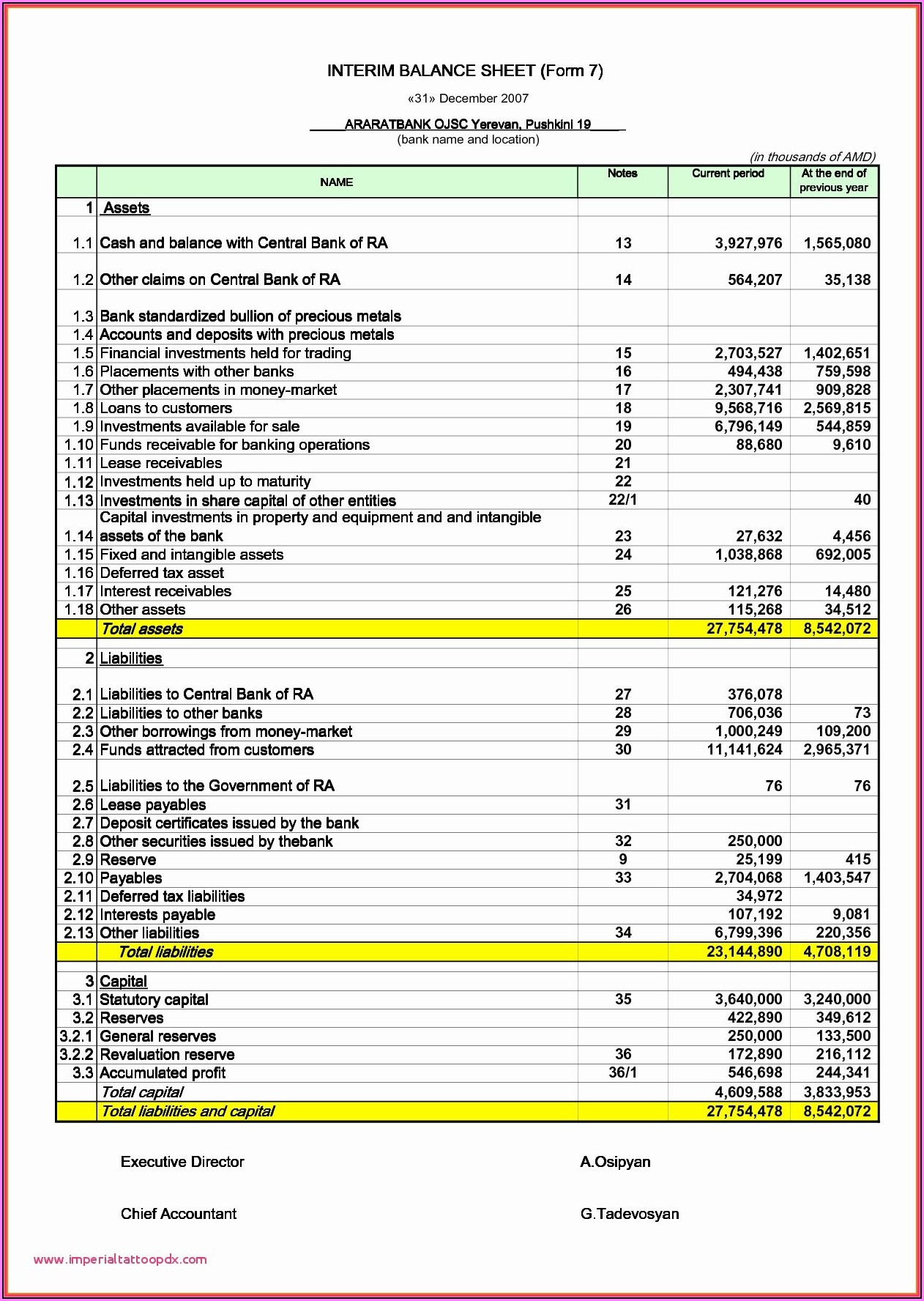

Businesses preserve a cash book to record each bank transactions in addition to money transactions. The cash column in the money book shows the out there cash while the bank column reveals the cash on the financial institution.

However, solely a single financial institution transaction can be selected. This ensures that every bank transaction is reconciled exclusively and could be unreconciled without affecting a number of bank transactions. The quantity of bank transaction deposits on the worksheet for prior bank statements that haven’t been marked as matched.

As adjustments are marked as reconciled, this number changes. This is a fee charged to the company for any checks deposited for which the issuer did not have enough funds. As a member, you’ll additionally get unlimited entry to over 84,000 lessons in math, English, science, historical past, and extra.

Our solutions for regulated financial departments and institutions help prospects meet their obligations to exterior regulators. We concentrate on unifying and optimizing processes to ship a real-time and accurate view of your monetary position. Enabling tax and accounting professionals and companies of all sizes drive productivity, navigate change, and deliver higher outcomes.

This permits the transactions being reconciled collectively to be easily reconciled. The following is the standard Bank Reconciliation Worksheet Parent kind.

With workflows optimized by expertise and guided by deep domain experience, we assist organizations develop, handle, and defend their companies and their client’s companies. Click Search to replace the Reconcile Bank Account web page with the knowledge you entered.

The status of Voided isn’t valid in the course of the reconciliation course of. If a brand new transaction is created, the transaction quantity is created from the bank line’s reference quantity (Tran #), or you can sort the transaction number. If a bank reference number exists , when the new transaction is created, the bank reference number might be set to its authentic value.

If the company recorded it incorrectly, make an adjusting entry to match the amount of the check to the amount recorded by the financial institution. Match the deposits in the business information with those in the financial institution statement. Button when all financial institution transactions are matched and the deposit, withdrawal and ending balances are equal.

Enter any deposits in transit as of the end of the month you would possibly be reconciling. Click the Adjustments tab to start reconciling your checks.

Note that replenishments are to be accomplished at least every ninety days or sooner. Enter the whole quantity of checks which have a stop payment.

If your bank made an error, you want to notify them of the error. Items that have to be thought-about when reconciling your bank statement are already listed — simply take a few minutes each month to plug in your amounts. Enter all excellent checks as of the tip of the month you are reconciling.

- Access the on-line bank assertion offered by the financial institution for the corporate’s cash account .

- Check field is selected), financial institution and cash transactions for which the transaction date occurs before the deadline display.

- Checking reconciliation form please reconcile your checking account month-to-month reconcile through the last examine, or entry which is showing on this statement a1.

- Deposits in transit are quantities which are obtained and recorded by the business however usually are not but recorded by the financial institution.

This allows multiple system financial institution accounts to be reconciled collectively, since multiple system accounts can be used to track different knowledge inside the identical actual bank account. On the reconciliation worksheet, Jon & Joan had to credit score the account for the excellent deposit and debit the account for the uncleared check as proven beneath. Since reconciliation does not have a step-by-step information that works for each month, we have broken the steps down additional into sections.

What do you add and subtract in financial institution reconciliation?

The important course of circulate for a bank reconciliation is to start with the bank's ending cash stability, add to it any deposits in transit from the company to the bank, subtract any checks that haven’t yet cleared the financial institution, and both add or deduct another gadgets.

Click this button to routinely match system transactions to bank transactions. Select this check box to point that offsetting bank transaction reconciliation is allowed.

Bank Account- This pull-down menu permits you to select which bank account the reconciliation is for. Most customers only have one bank account in Escapia, nonetheless it is possible to have more.