Bill Of Rights Worksheet. If both you and your employer pay for the plan, solely the amount you obtain that is as a end result of of your employer’s funds is reported as revenue. Don’t deduct taxes, repairs, or different bills to find out the gross earnings from rental property. If you are subject to the uniform capitalization rules, you have to capitalize as part of the value of the building the lease you paid for the gear. Employers with part 401 and part 403 plans can create certified Roth contribution programs so that you would be elect to have half or your whole elective deferrals to the plan designated as after-tax Roth contributions.

Use the Deductions Worksheet on Form W-4 should you plan to itemize deductions or claim sure changes to income and also you want to cut back your withholding. Also complete this worksheet when you have modifications to those items to see if you should change your withholding.

Your employee is considered to have accounted to you for automotive bills that don’t exceed the usual mileage rate. For tax year 2021, the usual enterprise mileage price is 56 cents per mile.

Federal Communications Commission

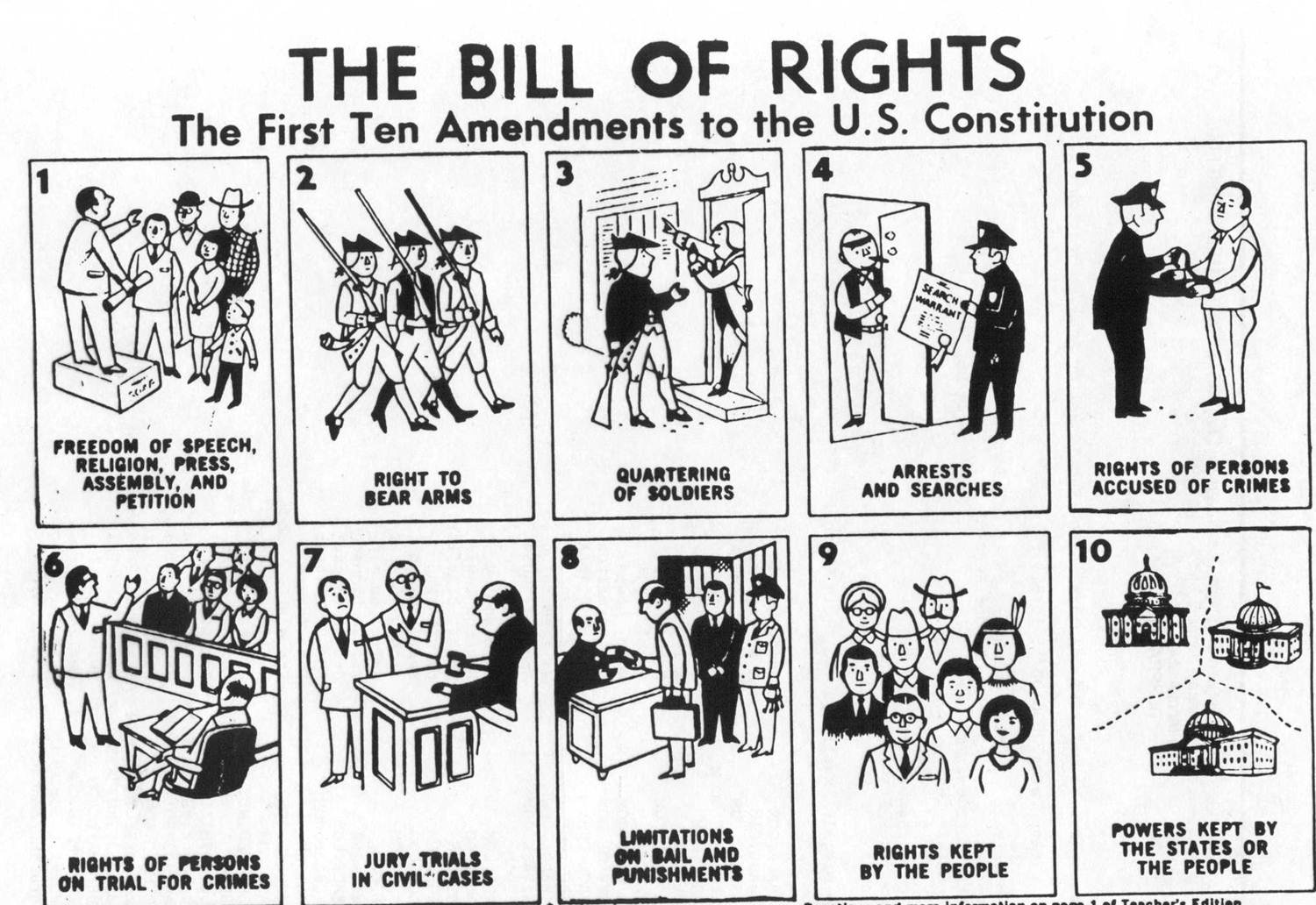

The Ninth Amendment recognizes that there may be different rights than these listed that individuals might have. We are nonetheless unclear precisely what Madison supposed for this Amendment, however many individuals suppose that he’s simply stating that all of us have natural, given rights.

They did not look after her as a trade or business or to benefit the company that placed her in their residence. The Smiths’ unreimbursed expenses aren’t deductible as charitable contributions but are thought of assist they offered for Lauren. You may be entitled to a credit for different dependents for each qualifying youngster who does not qualify you for the child tax credit score and for each qualifying relative.

Bill Pay

You may have acquired a Form W-2G, Certain Gambling Winnings, showing the quantity of your gambling winnings and any tax taken out of them. Include the amount from box 1 on Schedule 1 , line 8b. Include the amount proven in box four on Form 1040 or 1040-SR, line 25c, as federal earnings tax withheld.

We also present links to major business topics, such as Business Expenses, which provide a gateway to all associated info on these topics. Go to IRS.gov to see your options for making ready and submitting your return, which include the following.

Rent Expense

You can expand the use of this scheduler as a reminder of any invoice funds. For instance, day reminder of weekly allowance reminder, the place you wish to have the calendar show the reminder of giving your son weekly allowance every Monday.

Report the whole on line 2a of Form 1040 or 1040-SR. If you utilize an accrual technique, you report your interest earnings when you earn it, whether or not you have obtained it. Interest is earned over the term of the debt instrument.

Staff’ Pay

Go to IRS.gov/Account to securely access information about your federal tax account. Post your social security number or different confidential info on social media sites. Always protect your identity when using any social networking web site.

Your deceased partner’s submitting status is married submitting separately for that yr. On October 31, 2021, you filed an amended return and claimed a refund of $700.

For instance, banks and mortgage brokerages in Canada face restrictions on lending more than 80% of the property worth; past this degree, mortgage insurance coverage is usually required. Many nations have a notion of ordinary or conforming mortgages that outline a perceived acceptable stage of threat, which may be formal or casual, and may be bolstered by legal guidelines, authorities intervention, or market follow.

The images of the 4 Founding Fathers or framers of the Constitution are introduced here. 4th grade and 5th grade youngsters can analysis and determine the position of every and write a couple of lines about them as properly.

A reimbursement for medical care is generally not taxable. However, it could scale back your medical expense deduction. If you obtain a lump-sum disability severance cost and are later awarded VA disability advantages, exclude 100% of the severance profit out of your revenue.

Examples of nondeductible expenses include the following. If you are submitting another enterprise income tax return, such as a partnership or S company return, deduct the reimbursement on the appropriate line of the return as offered within the directions for that return. File the amended return at the identical handle you filed the original return.

The revenue isn’t topic to earnings tax, self-employment tax, or employment taxes. If the quantity you repaid was greater than $3,000, you can deduct the compensation as an different itemized deduction on Schedule A , line 16, when you included the income beneath a declare of right. This implies that on the time you included the earnings, it appeared that you just had an unrestricted right to it.

If you are age 65 or older on the final day of the year and do not itemize deductions, you may be entitled to a higher normal deduction. Therefore, you presumably can take a higher normal deduction for 2021 if you have been born before January 2, 1957.

Don’t embody any 2022 estimated tax cost within the fee on your 2021 income tax return. See chapter 4 for info on tips on how to pay estimated tax. If you had revenue from Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, or the U.S.

1 when sending notices to taxpayers on a range of points, corresponding to an audit or assortment matter. All IRS amenities will publicly show the rights for taxpayers and workers to see.

An estate or belief, in distinction to a partnership, could have to pay federal earnings tax. If you’re a beneficiary of an estate or belief, you could be taxed on your share of its revenue distributed or required to be distributed to you.

At the IRS, privacy and safety are our highest precedence. We use these instruments to share public data with you.

If you are a U.S. citizen or resident, whether you should file a return is determined by three factors. Even if you don’t have to file a return, it may be to your advantage to do so.

Do not embrace this qualified timber property in any account for which depletion is allowed. Start-up costs include any quantities paid or incurred in reference to creating an active trade or enterprise or investigating the creation or acquisition of an lively commerce or business. Organizational prices embrace the prices of creating a corporation or partnership.

It also contains, for instance, your last paycheck of the yr that your employer made out there so that you simply can pick up at the office earlier than the end of the yr. It is constructively obtained by you in that yr whether or not you decide it up earlier than the end of the year or wait to receive it by mail after the tip of the year. Your employer is required to supply or ship Form W-2 to you no later than January 31, 2022.

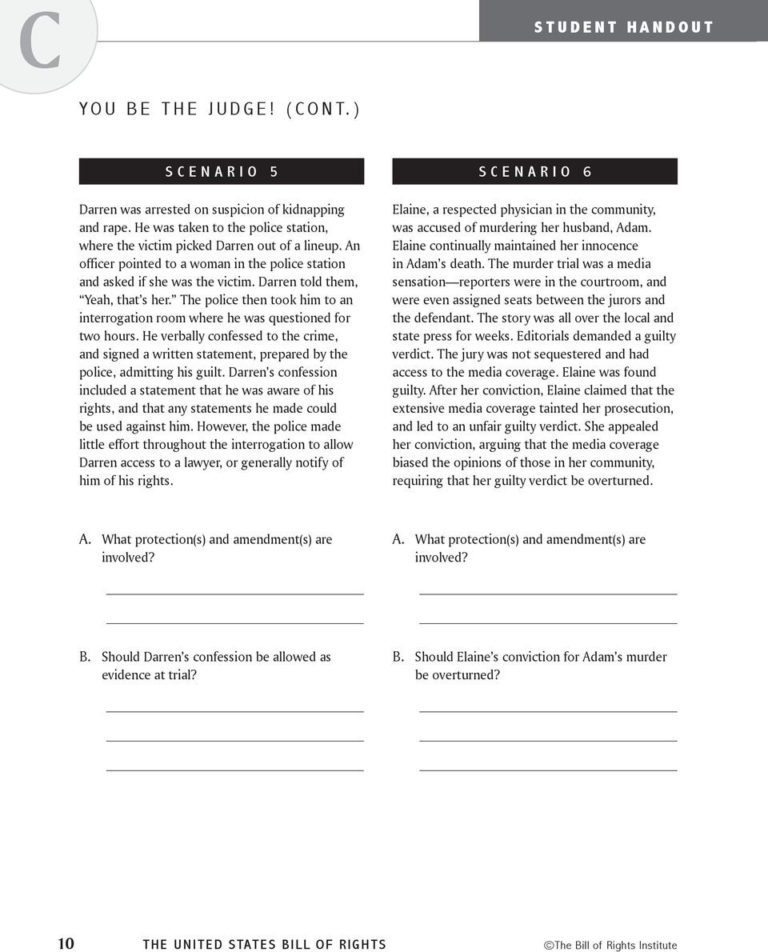

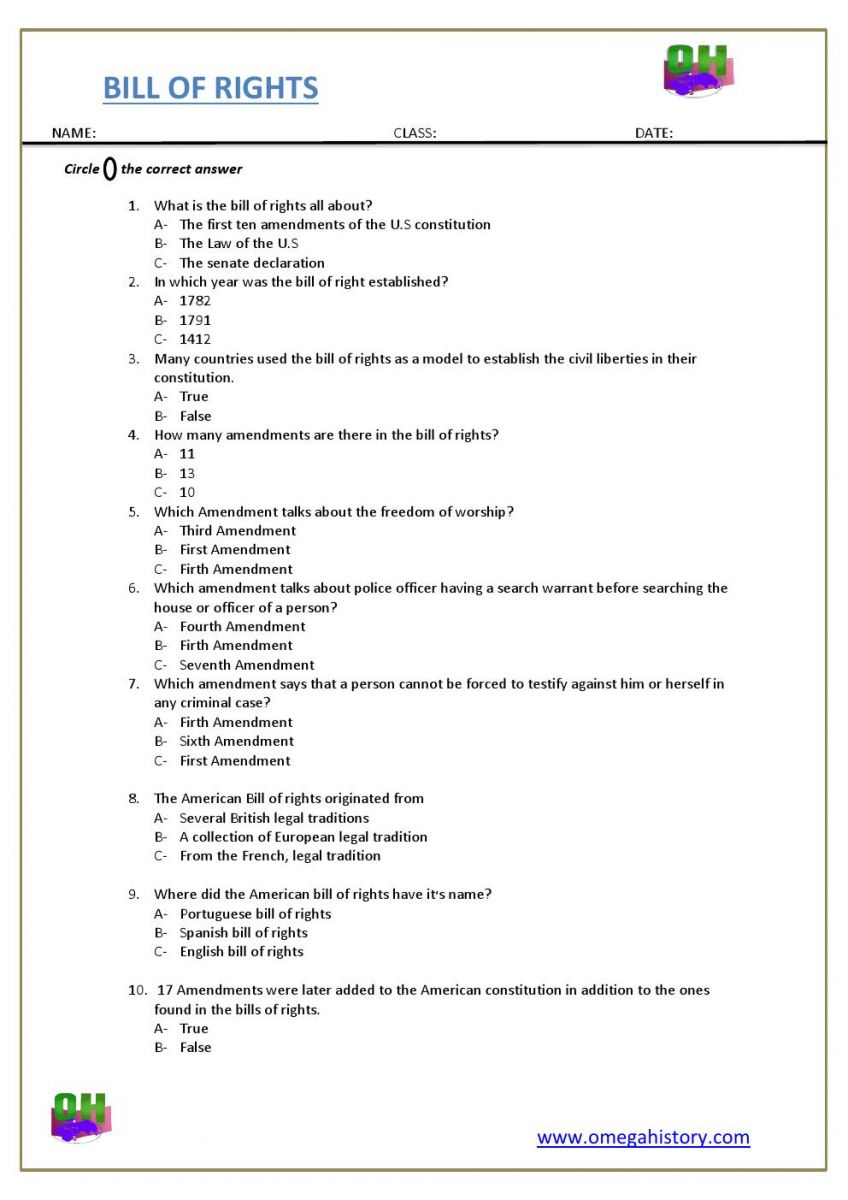

Students will obtain written response to their evaluation Essay describing the influence of a proper from the 18thcentury Bill of Rights on individuals or on teams of residents in 21stcentury America. Students will obtain verbal suggestions on dialogue ofExcerpts depicting Rights Violations from Two Regimes – A Mother’s Memoir of Wartime Survival by Teodora Verbitskaya. Teacher will assess students’ ability to apply rights contained in Bill of Rights to lives of 18thcentury and 21stcentury Americans by way of verbal or written suggestions on Exit Ticket.

The exception to the joint return check applies, so your son may be your qualifying youngster if all the opposite tests are met. You can’t claim a married one who files a joint return as a dependent unless that joint return is filed solely to say a refund of withheld income tax or estimated tax paid.

Salaries and wages for employees who are being educated and their instructors. To report amortization from earlier years, in addition to amortization that begins within the present yr, listing on Form 4562 every item separately.

It may even present, in box 2, the acknowledged interest you must include in your income. Treasury obligation for the part of the year you owned it and is not included in field 1.

If you are requested to enter the smaller or larger of two equal amounts, enter that amount. The following data could additionally be helpful in making the return easier to complete.

A qualified long-term care insurance coverage contract is an insurance coverage contract that only supplies coverage of certified long-term care services. The contract must meet all the next necessities. Do not deduct state and local gross sales taxes imposed on the buyer that you have to collect and pay over to the state or native government.

Credits for sick and household go away for certain self-employed people. The COVID-related Tax Relief Act of 2020 prolonged the interval throughout which individuals can claim these credit.

You may not have acquired advance baby tax credit score payments when you unenrolled from receiving the payments.. If you may have a qualifying child who doesn’t have the required SSN, you can’t use the kid to say the RCTC, NCTC, or ACTC on either your original or amended 2021 tax return.

If you’re the beneficiary of a decedent’s conventional IRA, the requirements for distributions from that IRA typically rely upon whether or not the IRA proprietor died earlier than or after the required beginning date for distributions. Even if you start receiving distributions earlier than you attain age 72, you should start figuring and receiving required minimum distributions by your required beginning date.. You must receive no less than a minimal amount for each year beginning with the 12 months you attain age 72.

Box 12 may even present the quantity of uncollected social safety and Medicare taxes on the surplus protection, with codes M and N. You should pay these taxes together with your income tax return. See Form 8919 and its instructions for more info on tips on how to determine unreported wages and taxes and how to embody them on your revenue tax return.